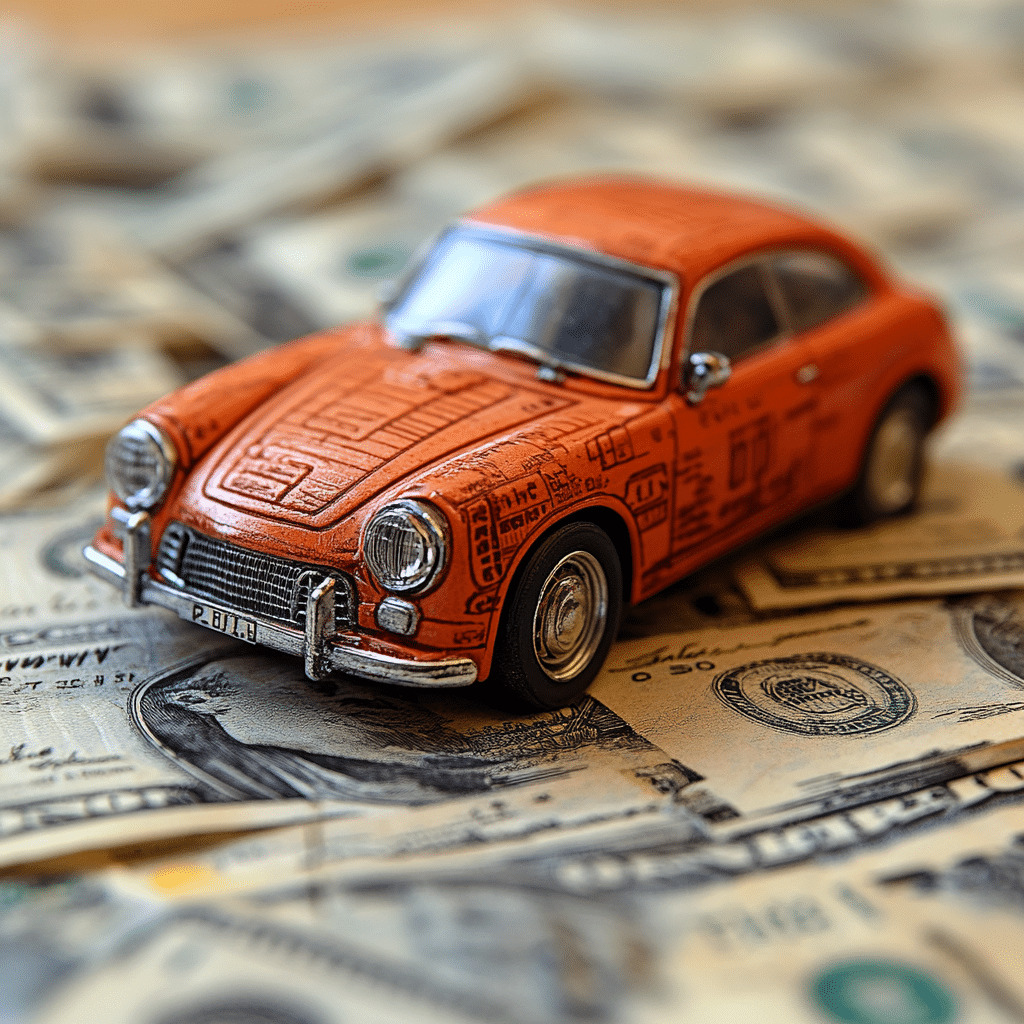

Let’s face it: life can toss us a few curveballs, especially when it comes to finances and credit scores. If yours has taken a hit, don’t panic! Car loans for bad credit can make your dreams of hitting the open road a reality. In a world where a reliable ride can land you a job, pick up those killer women’s tank tops for your next date night, or just get you from Point A to Point B, having the right financing can transform your situation.

Understanding your financial options is key to breaking free from the grips of poor credit. Sure, the road ahead may be filled with some bumps, but securing a car loan with less-than-stellar credit isn’t just a pipe dream. With a sprinkle of knowledge and a dash of determination, you can snag the set of wheels you’ve been eyeing. So let’s dive into the nitty-gritty of car loans for bad credit and get you back on track!

Understanding Car Loans for Bad Credit

Think about it: you’ve got a job that might be linked to medical billing and coding, and you need a reliable car to get to those interviews or your current job across town. Unfortunately, your credit score looks like a sock lost in the dryer—terrible. Car loans for bad credit exist precisely for situations like yours. Traditional lenders often scoff at anything below a certain number—usually 620. But don’t sweat it; options are out there!

Some lenders cater specifically to folks like you. These bad credit car loans tend to come with higher interest rates but think of it this way: it’s a stepping stone to rebuilding your credit. Just keep your eyes peeled for flexible repayment plans and terms that align with your financial goals. Don’t forget to check out online marketplaces; they often give you a better shot since they cut out the middleman.

Now, to take control of your finances, be proactive. Know your credit score. Figuring out where you stand can give you an idea of what to expect. It’s like going into a high-stakes poker game knowing your hand—you’re better off. Look for lenders that report to credit bureaus, so when you make those timely payments (and you will), your credit score can start getting some love!

Top 5 Car Loans for Bad Credit in 2024

Let’s get you ranked with the top players in the bad credit car loan league. We’ve checked out several options, and these five lenders shine brighter than a new Samsung S25 at sunset.

Factors Influencing Approval for Bad Credit Car Loans

When you apply for car loans for bad credit, remember: it’s not just about credit scores. Lenders are detectives, sniffing out various factors that tell them you’re worth the risk:

Innovative Financing Solutions: Earned Wage Access Apps and Loans

In this fast-paced gig, managing your cash flow can trip you up. Enter earned wage access apps like PayActiv and DailyPay. These gems allow you to tap into your earned wages before the usual payday chaos. That’s right—early access to cash!

If you’ve got a car payment looming but are waiting for that paycheck to drop, these apps can be lifesavers. Imagine being diligent in your loan payments, keeping your credit score climbing while not rushing to find the cash. Perfect for smooth sailing when juggling medical billing and coding needs against those fleeting social events that need your wheels.

The Road Ahead: Final Thoughts

In a time like today, where transportation can be the key to new jobs, education, or merely enjoying life, car loans for bad credit can be a lifeline. It’s all about playing the game smartly. Whether it’s through the benefits of earned wage access apps or various supportive financing options, your dream of owning a car can be just around the bend.

We’ve handed you the keys. Stay informed, explore your options, and tackle those financial hurdles head-on. Dive into the process, and soon enough, you’ll be cruising confidently, making your aspirations a reality. Don’t let bad credit keep you down; get out there and claim those keys to freedom!

Car Loans for Bad Credit: Unlocking Your Dream Ride

The Real Deal on Bad Credit Car Loans

Did you know that nearly 30% of Americans have a credit score considered bad? That’s a significant chunk of folks who could be worried about getting a decent car loan. But here’s a little trivia nugget: car loans for bad credit can sometimes come with lower interest rates than personal loans or credit cards. These loans can help turn that dream car into a reality, allowing you to hit the road in style. If you’re curious about what’s out there, you might want to check out saddle shoes for that classic vibe while you drive into the sunset.

Flexibility in Options

Lenders understand that life happens. Whether it’s a medical emergency, job loss, or just an unexpected financial hiccup, people fall on hard times. That’s why car loans for bad credit often come with flexible terms. For instance, some lenders provide a pre-approval option, allowing you to see what you’re working with before making any commitments. Plus, if you play your cards right, you can take advantage of dealer financing as well. And speaking of perks, did you know that many companies offer bonus rewards or discounts for loyal customers? You might want to explore popular womens tank tops to wear while you show off that new ride!

Keep It Moving

While the landscape of financing choices is constantly changing, a little research can lead you in the right direction. For example, looking for terms you can afford or keeping an eye on your credit report can really neck down the options. Plus, don’t forget about online platforms that specialize in amazion prime savings. They often offer auto loan products that cater specifically to individuals with bad credit, making it easier than ever to get on the road. Just remember, don’t rush into anything — take the time to understand your options.

In the end, car loans for bad credit might seem intimidating, but with the right mindset and info, you can navigate the process like a pro. And who knows? You might even develop an interest in the more adventurous side of life, wandering into the world of voyeurism or seeking out amazing new hobbies. So, take that leap! Your dream car is one good choice away.

Can I get approved for a car loan with a 500 credit score?

Getting approved for a car loan with a 500 credit score is tough but not impossible. Some lenders specialize in bad credit financing, so it’s worth shopping around.

What is the best car loan for bad credit?

For bad credit, look for lenders that specifically cater to individuals with credit issues. Credit unions and subprime finance companies might offer better rates than traditional banks.

What is the lowest credit score to get a car loan?

The minimum credit score to get a car loan typically hovers around 500, but different lenders may have varying requirements.

How hard is it to get approved by Carvana?

Getting approved by Carvana can be relatively straightforward. They use a range of factors beyond credit score, like your income and the type of vehicle you’re buying.

Can I finance a car with a 480 credit score?

Financing a car with a 480 credit score can be tricky, but some lenders do consider subprime applications. You might face higher interest rates.

Who gives loans to 500 credit score?

Lenders like Carvana, Credit Acceptance, or some local dealerships might approve loans for those with a 500 credit score, though the terms won’t be the best.

Which car company is easiest to get financing?

Generally, companies like Kia and Honda are known for being easier to finance through, but it also depends on the dealership’s policies.

Does Westlake Financial approve everyone?

Westlake Financial doesn’t approve everyone, but they are more open to working with those who have lower credit scores compared to traditional lenders.

What do I need to finance a car at CarMax?

To finance a car at CarMax, you typically need a valid ID, proof of income, and proof of residence. Having your Social Security number handy is also a good idea.

How much down do I need to buy a car with bad credit?

Having a down payment can help improve your chances, and while it varies, around 10% is often a good aim for buyers with bad credit.

How accurate is credit karma?

Credit Karma gives a decent snapshot of your credit score, but it may not be 100% accurate. It’s based on a model that may differ from what lenders use.

Does Capital One offer car loans?

Yes, Capital One does offer car loans, and they have specific options for varying credit situations.

What is the minimum credit score to buy a car from Carvana?

At Carvana, the minimum credit score for financing generally falls around 550, but they consider other factors as well.

How to get a car with bad credit and no money down?

To get a car with bad credit and no money down, you might need to check with specific dealerships that have programs for such situations, but it could be tough.

What’s a good APR for a car?

A good APR for a car loan is generally around 3-5% for those with good credit. If you have bad credit, expect higher rates.

What is the best car to buy with bad credit?

For those with bad credit, reliable used cars, such as older model Toyotas or Hondas, can be good choices due to their longevity.

What kind of car loan rate can I get with a 700 credit score?

If you have a 700 credit score, you could expect a loan rate between 2 to 5% depending on the lender and the type of loan.

How to get a car with a repo and bad credit?

Getting a car with a repo and bad credit might require a down payment or higher interest rates, but some lenders still consider your situation.

How to get a car with bad credit and no cosigner?

Financing a car with bad credit and no cosigner is challenging, but some dealerships cater to buyers in your shoes, so it’s worth researching.

How big of a loan can I get with a 500 credit score?

With a 500 credit score, you might qualify for a loan up to $10,000, but it really depends on the lender and your income.

What is the average interest rate on a car loan with a 500 credit score?

On average, interest rates on car loans for a 500 credit score can be quite high, often ranging from 12% to 20% or even more.

Can you put $500 down on a car with no credit?

Yes, you can usually put $500 down on a car with no credit, though the options may be limited, and you might face higher interest rates.

Can I get a car with a 350 credit score?

Getting a car with a 350 credit score is extremely difficult, as most traditional lenders won’t approve loans at that level, but some specialized lenders might help.